2025 Roth Ira Phase Out. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. Learn how to utilize this tax strategy.

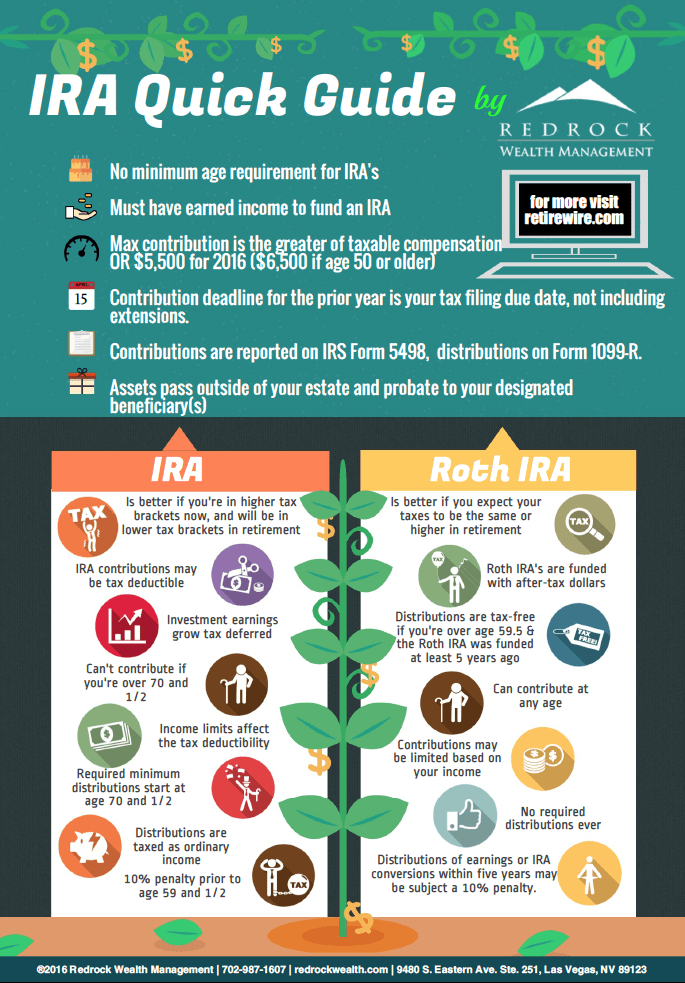

The administration has not yet given details about the kinds of ira rule changes to be included in the final version of the new budget proposal, which would. You can contribute to an ira at any age.

How do phaseouts of tax provisions affect taxpayers? Tax Policy Center, When eligible, an account holder can withdraw roth contributions and. Contribute to an individual retirement plan like a roth ira or traditional ira?

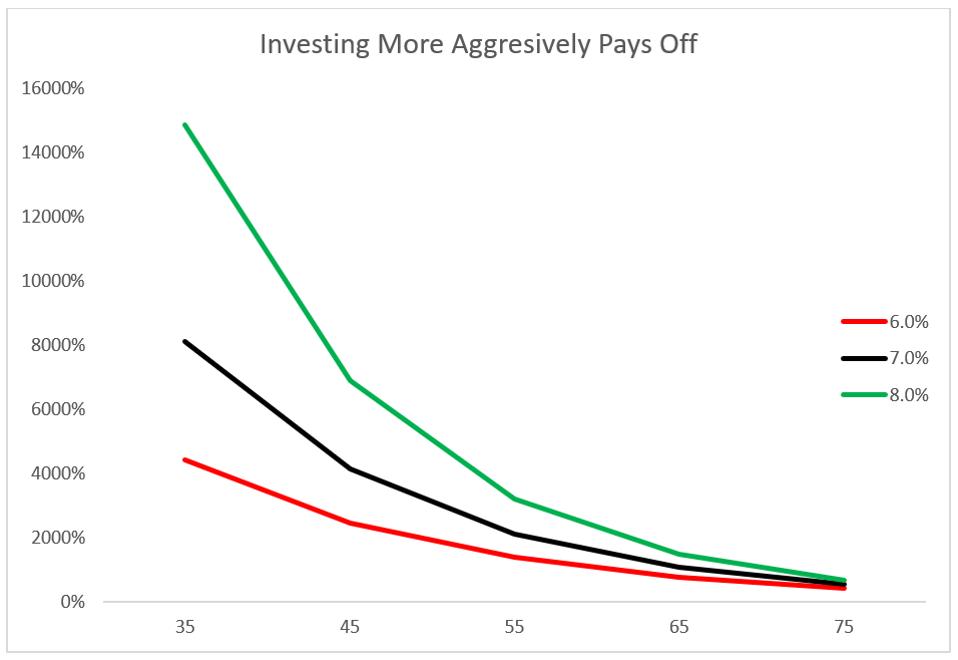

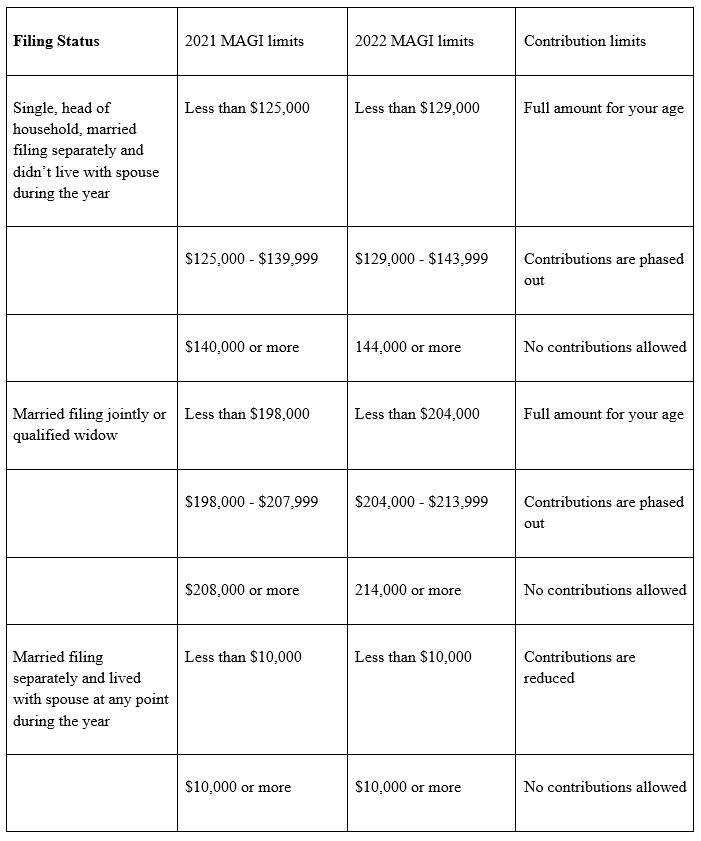

ROTH IRA Conversion Power And TaxFree, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. Your contribution limit begins to phase out at $138,000 in adjusted gross income if you file taxes as a single person, $218,000 if you are married and file jointly,.

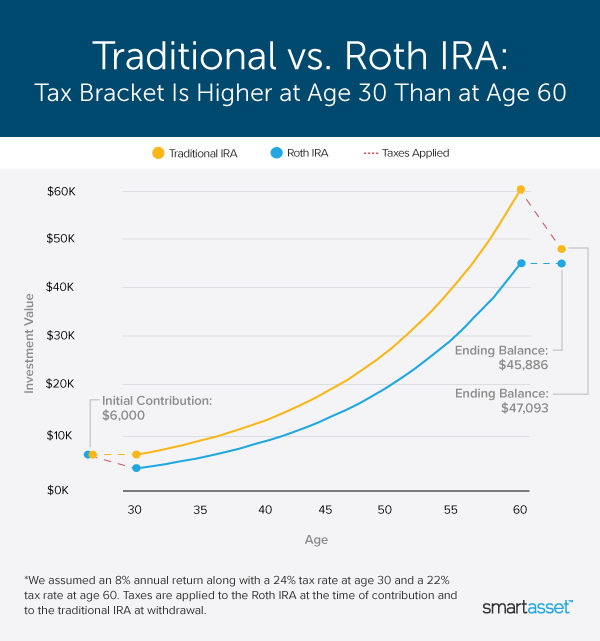

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, You can make 2025 ira contributions until the. Your contribution limit begins to phase out at $138,000 in adjusted gross income if you file taxes as a single person, $218,000 if you are married and file jointly,.

The ultimate IRA & Roth IRA quick guide RetireWire Online financial, The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older. Your personal roth ira contribution limit, or eligibility to.

Using Online Calculators to Choose between Traditional and Roth IRAs, 2025 roth ira phase out limits elfie helaina, 401 (k) contribution limits 2025. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, Defined contribution retirement plans will be able to add. The roth ira income limits are less than $161,000 for single tax filers and less than.

Roth IRA For Kids Make Your Grandchildren Millionaires RetireGuide, You cannot deduct contributions to a roth ira. The roth ira income limits are less than $161,000 for single tax filers and less than.

Roth IRA vs. Traditional IRA Which One is Right for You? Wedbush, Knowing the contribution maximums, plan establishment (or. Roth accounts may work better than ever as a tool for saving for retirement.

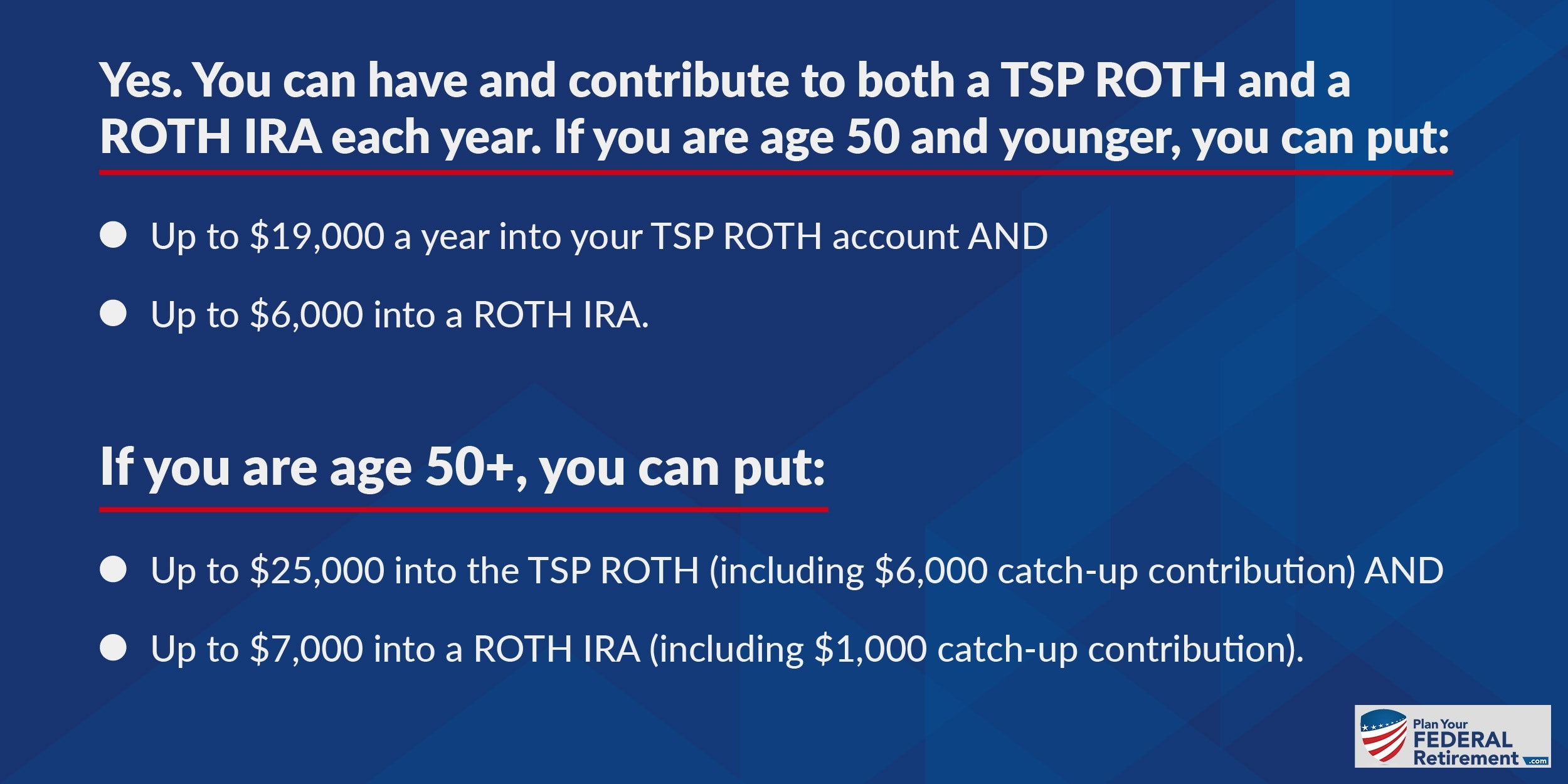

"Can you have a Roth TSP and a Roth IRA?" Plan Your Federal Retirement, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. Roth accounts may work better than ever as a tool for saving for retirement.

IRA Contribution Limit The.Ismaili, Your next step is to determine how much you can contribute, based on your level of income. Defined contribution retirement plans will be able to add.

The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.